Understanding Strategic Asset Allocation

Strategic Asset Allocation (SAA) is the process of setting long-term target allocations for a portfolio’s asset classes such as equities, fixed income, real assets, alternatives, and cash based on the investor’s objectives, risk tolerance, time horizon, and liquidity needs. These allocations are periodically rebalanced to maintain the defined structure, regardless of short-term market fluctuations.

For high-net-worth (HNW) investors, SAA goes beyond major asset classes. It often includes tailored exposures to private equity, hedge funds, real estate, infrastructure, art, and even unconventional assets. The process is based on principles of diversification and optimizing risk-adjusted returns, aiming to engineer not only growth but also resilience across various market cycles.

Tangible Benefits of Strategic Asset Allocation

1. Risk Management and Downside Protection

SAA helps mitigate concentration risk by ensuring a portfolio isn’t overly reliant on any single asset class, geography, or sector. This diversification is especially important for HNW families with substantial legacy business holdings or real estate concentrations. By systematically diversifying across asset classes, geographies, and even providers or firms, SAA helps shield portfolios from market turbulence. For instance, during the ‘08 financial crisis, portfolios with meaningful allocations to fixed income, cash, and alternatives saw significantly smaller drawdowns compared to those concentrated in equities or illiquid assets.

2. Return Consistency and Compounding

By balancing high-growth assets with defensive ones, SAA smooths out the volatility of returns over time, enabling steady compounding, which is a crucial factor in building generational wealth. Academic studies, such as Brinson, Hood, and Beebower (1986), have shown that more than 90% of a portfolio’s long-term returns and volatility can be attributed to asset allocation, rather than individual security selection or market timing.[1]

3. Behavioral Discipline

SAA imposes a structured rebalancing approach, which helps investors avoid emotional, ill-timed decisions. When markets rise, rebalancing encourages trimming winners and adding to underperforming assets, systematically buying low and selling high. Conversely, during significant market drops, the portfolio naturally shifts into oversold assets. This structure is vital for HNW investors, who may otherwise allow emotions or legacy biases to drive decisions, especially given the scale and complexity of their portfolios.

The frequency of rebalancing is essential for its effectiveness, and the optimal cadence typically ranges from quarterly to semi-annually, depending on market conditions and portfolio size.

4. Customization and Alignment

For HNW individuals and families, SAA is not a one-size-fits-all model. It can be customized to align with personal values, philanthropic goals, tax considerations, and unique liabilities. An SAA framework can incorporate private foundations, trusts, and family office investments, integrating business interests and alternative assets into the overall wealth plan.

5. Efficient Use of Illiquidity Premiums

HNW investors often have the financial flexibility to take advantage of illiquid alternatives, such as private equity, real estate, and direct investments, which offer premium returns over public markets. SAA ensures these exposures are proportionate to the investor's overall risk appetite and liquidity needs, rather than growing unchecked.

Case Study 1: The Power of Strategic Asset Allocation

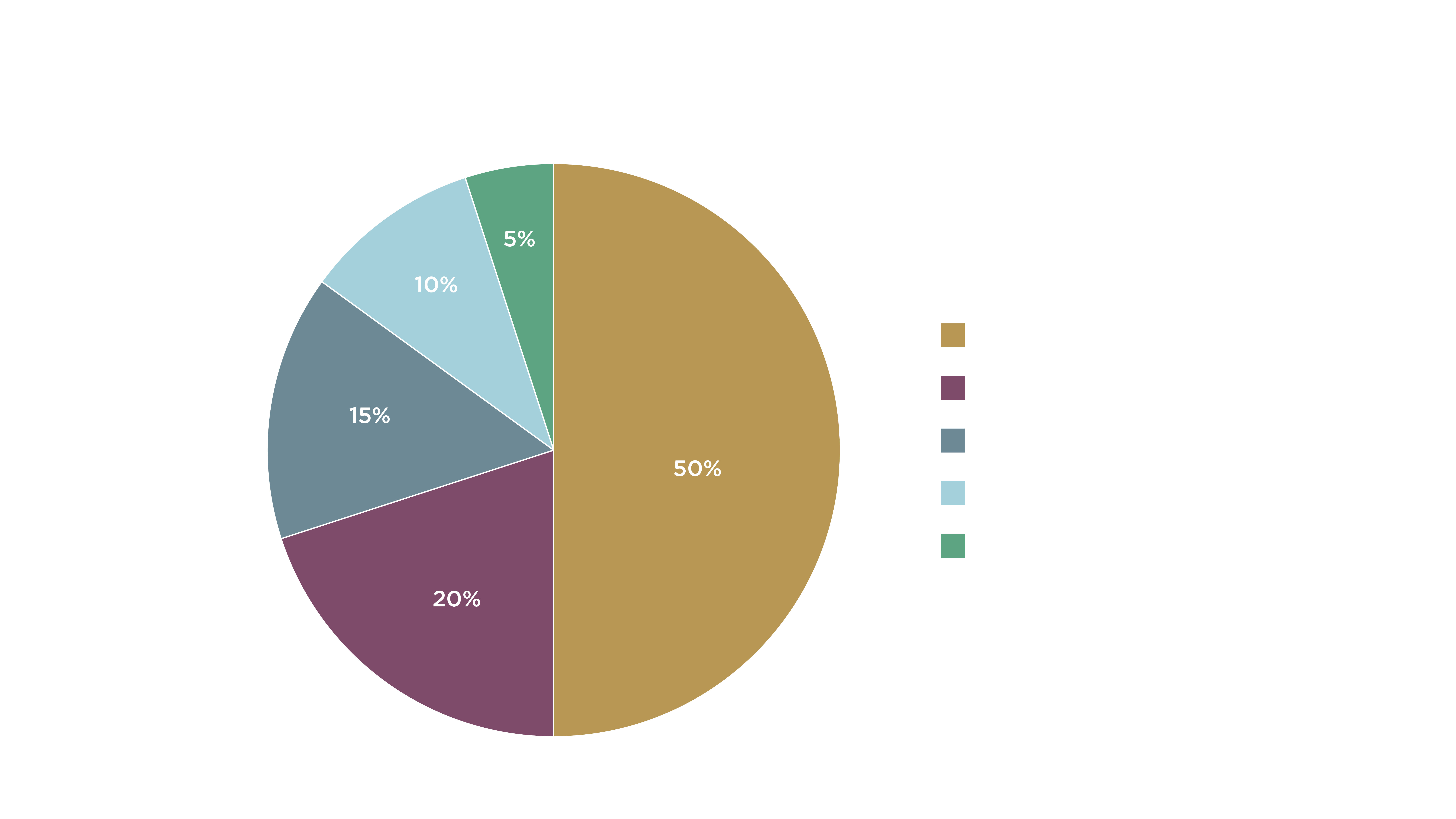

Consider a family office managing a $500 million portfolio. In 2005, the Investment Policy Statement (IPS) set a target allocation of 50% global equities, 20% global fixed income, 15% private equity, 10% real estate, and 5% cash. This strategic allocation was designed to provide growth, income, and resilience.

During the '08 financial crisis, global equities fell by around 40%,[2] but the portfolio’s exposure to fixed income, real estate, and cash helped cushion the impact, resulting in a 17% peak-to-trough drawdown. Systematic rebalancing during the sell-off allowed the family office to purchase equities at depressed prices in 2009, which accelerated the subsequent recovery. By 2012, the portfolio not only recovered its losses but also surpassed its pre-crisis value, thanks to both disciplined allocation and opportunistic rebalancing.

Over a 15-year period (2005–2020), the portfolio achieved an annualized return of 7.2% with a volatility of 9.5%. More importantly, it avoided the severe downturns and emotional mistakes associated with ad hoc investment decisions, demonstrating the compounding power of a disciplined strategic asset allocation.

Case Study 2: Absence of Strategic Asset Allocation

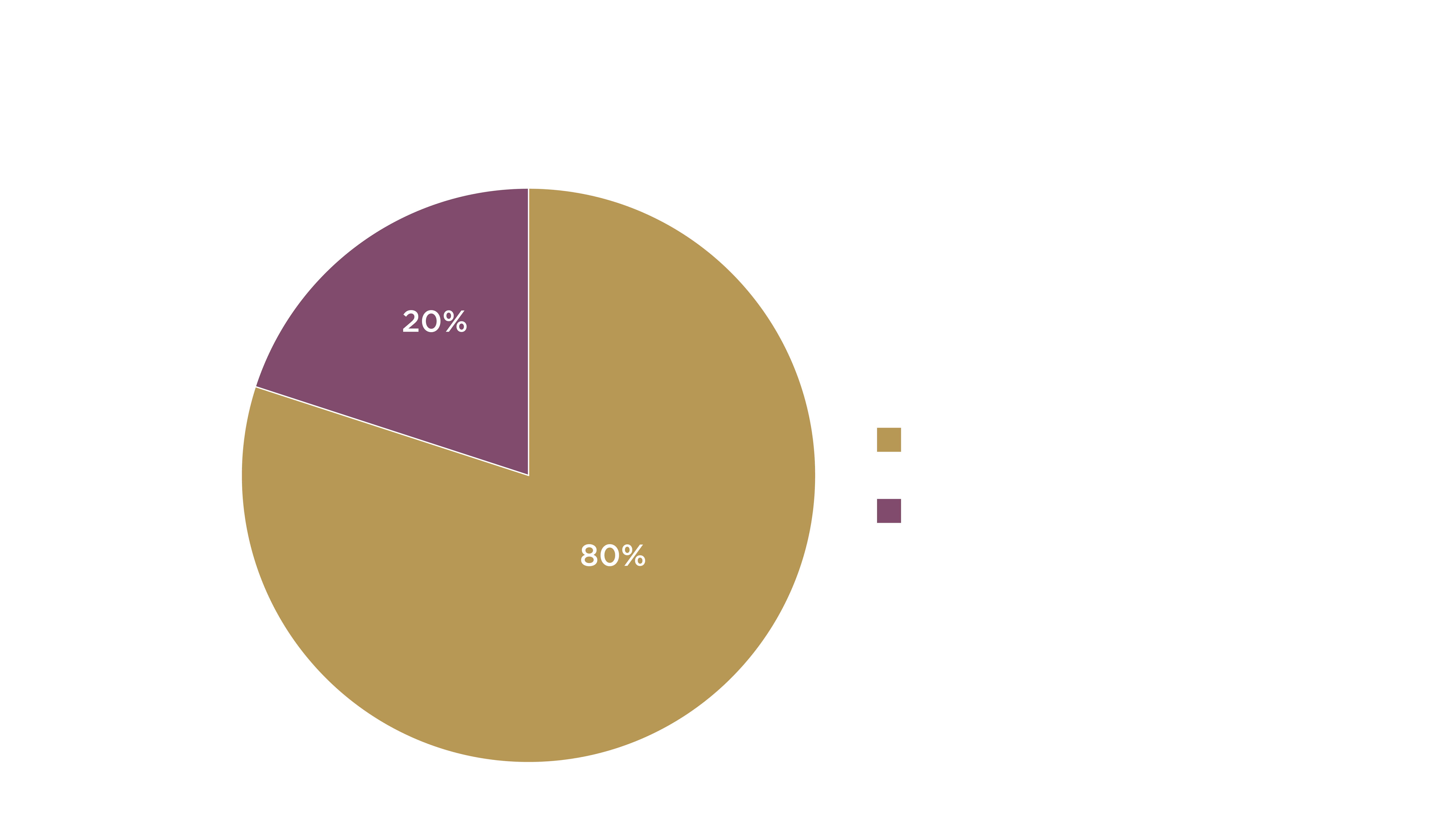

In contrast, consider a similarly sized entrepreneurial fortune that neglected SAA, allowing longstanding business interests and real estate to dominate the portfolio (80%), with minimal diversification into other asset classes.

When the underlying industry faced disruption in the late 2010s due to technological shifts and regulatory changes, the portfolio suffered an over 50% decline, with little liquidity to capitalize on new opportunities. The lack of diversification and rebalancing discipline locked in losses and delayed recovery, ultimately impairing the family’s ability to meet philanthropic commitments and sustain its lifestyle.

Comparative Impact on Portfolio Performance

Empirical analysis consistently supports the advantages of SAA. Research from Vanguard[3] and BlackRock[4] show that diversified portfolios with strong strategic allocations tend to provide superior risk-adjusted returns over the long term. While they may not always achieve the highest returns in any given year, they help reduce volatility compared to concentrated, non-diversified portfolios.

For example, over long-term periods, a balanced global 60/40 portfolio tends to deliver stable returns with moderate volatility. In contrast, single-asset or sector-concentrated portfolios often experience higher drawdowns, longer recovery periods, and greater emotional stress for investors. The power of SAA lies not only in optimizing returns but also in reducing the behavioral and capital risks that result from poorly timed decisions and a lack of disciplined rebalancing.

Strategic Asset Allocation in Practice: Implementation Considerations

For HNW investors, effective SAA means:

Setting actionable and robust Investment Policy Statements (IPS) that outline objectives, constraints, and rebalancing protocols.

Integrating business, philanthropic, and personal interests to ensure all assets contribute harmoniously to the overall goals.

Leveraging advanced analytics, scenario stress testing, and regular reviews to keep the asset allocation aligned with changing circumstances.

Employing dedicated family office or professional investment teams with the expertise and authority to execute and monitor the allocation strategy.

Standardizing metrics for proper comparability, which is essential for effective benchmarking and ongoing portfolio performance analysis.

Ensuring the right ingredients are in place to bring everything together with a disciplined approach, including diversified manager selection, access to high-quality deals, liquidity planning, active oversight and management, and risk management.

Conclusion

SAA is not just a theoretical concept, it’s a proven framework that delivers tangible benefits for HNW investors, including improved risk management, enhanced portfolio resilience, and more reliable achievement of financial goals. Real-world experience and empirical data consistently show that investors who embrace SAA outperform those who rely on concentration, market timing, or ad hoc decision-making. For HNW individuals who aim for lasting wealth and legacy, strategic asset allocation isn’t just prudent, it’s essential.

Contact your relationship manager to discuss how strategic asset allocation can support your wealth strategy and learn more about how we can help you implement this approach effectively.

[1] Brinson Et Al. (1986) - Determinants of Portfolio Performance