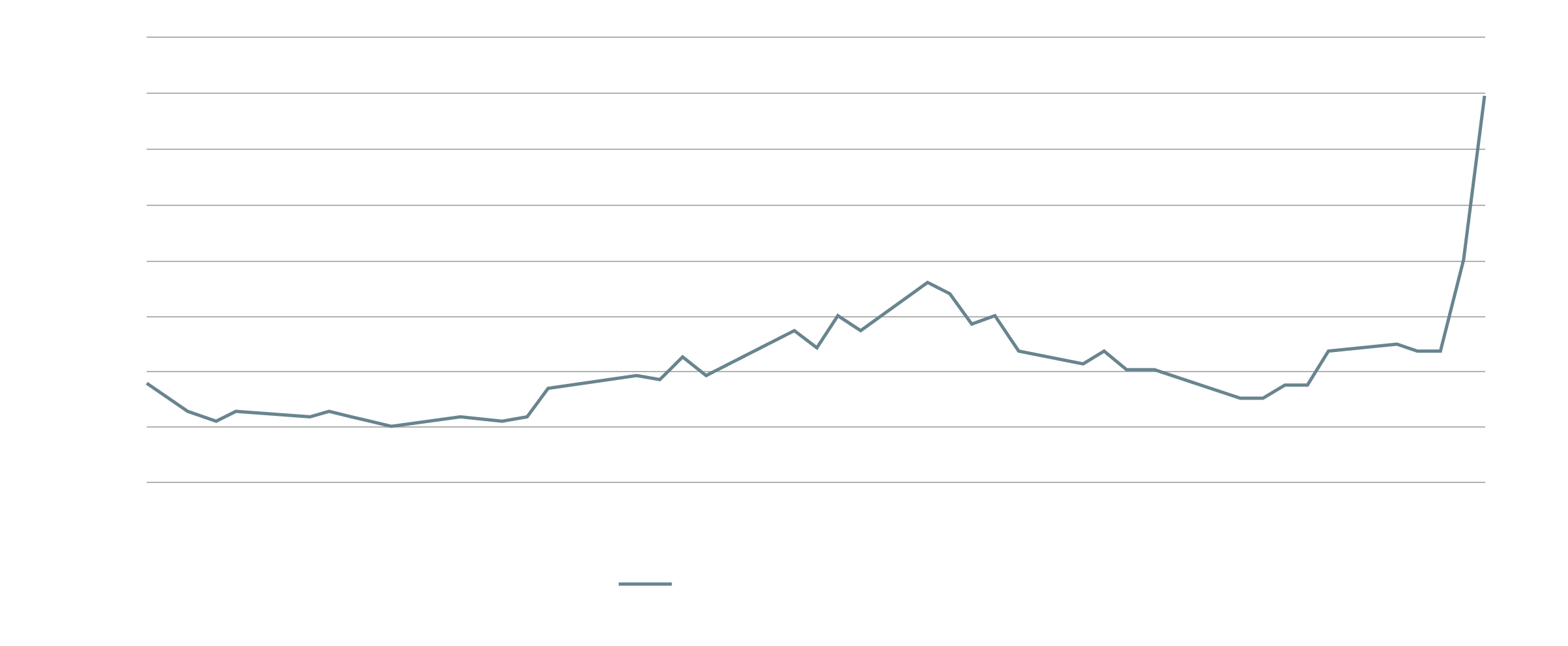

Just ten days later, the S&P 500 began a sharp decline, losing over 1,000 points in under two months. Since then, the CBOE Volatility Index (VIX) has surged from a range of 15–20 to more than double that figure, reaching as high as 60 on April 7th.[1]

Market cycles inevitably include periods of turbulence. While catalysts – in this case, the sweeping tariff measures introduced by the Trump administration[2] - may take different forms, volatility is a recurring theme that investors must be prepared to face.

That said, many believe the current turmoil may not pass quickly, especially if, as some commentators suggest, the U.S. is indeed aiming to implement a structural shift in global trade and international relations.[3] Until a new equilibrium is reached, investors should consider how to better insulate their portfolios from ongoing volatility.

Guarding Against Volatility

We have previously explored how private market investments, across private equity, credit, infrastructure, and real estate, can serve as valuable diversification tools. In fact, diversification remains one of the few reliable ways to navigate uncertainty.

Private investments offer two key advantages over public markets: insulation and control. Their valuations aren't subject to real-time pricing, which helps protect investors, and portfolio company’s internal management, from the emotional swings of daily market noise.

What’s more, active ownership in private firms enables a more flexible and strategic response to real-world change, unlike the passive nature of holding a small stake in a large public company.

It’s not just about resilience during periods of higher volatility. Evidence continues to show that private markets may actually outperform during times of crisis.

Outperformance in the Eye of the Storm

A report by Schroders Capital released in October 2024[4] showed that private equity not only outperformed public markets over the past 25 years overall (by approximately 4%), but that this outperformance margin widened during the five major crises that occurred over that period.

Source: Schroders Capital

Source: Schroders Capital

Looking specifically at performance during the crises, private equity outperformed the MSCI ACWI Gross Index by an average annualized excess return of 8%, twice the overall average. In other words, outperformance is the norm, and the stormier the environment, the higher the outperformance. As a result, private equity stands out not just for its return potential, but also for its value in managing portfolio risk.

A separate study from a few years earlier by Neuberger Berman[5] found similar patterns when analyzing private equity performance during periods of market stress. During the Global Financial Crisis of 2007–2009, for instance, the U.S. Buyout sector saw a total decline in asset value of 28% - roughly half the 55% drop recorded by the S&P 500.

The Neuberger Berman report also offers additional data showing how the structural features of private equity make such strong outcomes not only possible, but also likely. Thanks to their structure and pre-committed capital, private equity funds are able to continue deploying capital during downturns. This can lead to a stronger recovery later on, as funds are buying just when public investors are fleeing to safety, leaving oversold and attractively priced companies for the taking.

Additionally, private equity funds, with their long-term investment horizon, are not forced to sell at distressed valuations during periods of market pessimism. Their investors have already committed to the same long-term timeline, which means the fund is not forced to act reactively when public sentiment turns negative.

Conclusion

The case for private markets, as demonstrated above, is a very strong one. Private equity in particular, has shown 25 years of outperformance, and even stronger results during times of crisis. By contrast, public markets often appear overvalued by historical standards, exposing investors to a higher probability of loss.

On a more fundamental level, the smaller companies that private market investors deal with tend to have naturally higher upside potential, greater agility due to their smaller scale, and are free from the pressure of meeting short-term targets.

However, it’s important to remember that not all private deals are created equal. The headline figures represent an aggregate view of a highly segmented market, one with many different approaches and teams.

While they enjoy some independence from the wider market, private deals depend heavily on the individuals involved: the lead investors and the management team. The advantages of private markets are real, but they are not easily or cheaply bought. They require access, judgment, and experience.

At The Family Office, we’ve been helping clients diversify into private markets for more than two decades. That’s why we make our recommendations with conviction, especially in times like these, when clarity is rare and confidence is in short supply.