What We Know

Almost all signs indicate that the music is still at full blast, to continue with the ex-Citi chief’s analogy. Perhaps the most important bellwether of all, the US GDP growth, is estimated at a solid 3.9% for the current quarter.[2] Global growth estimates range from 2.3[3] to 3.0%[4] according to the main forecasts.

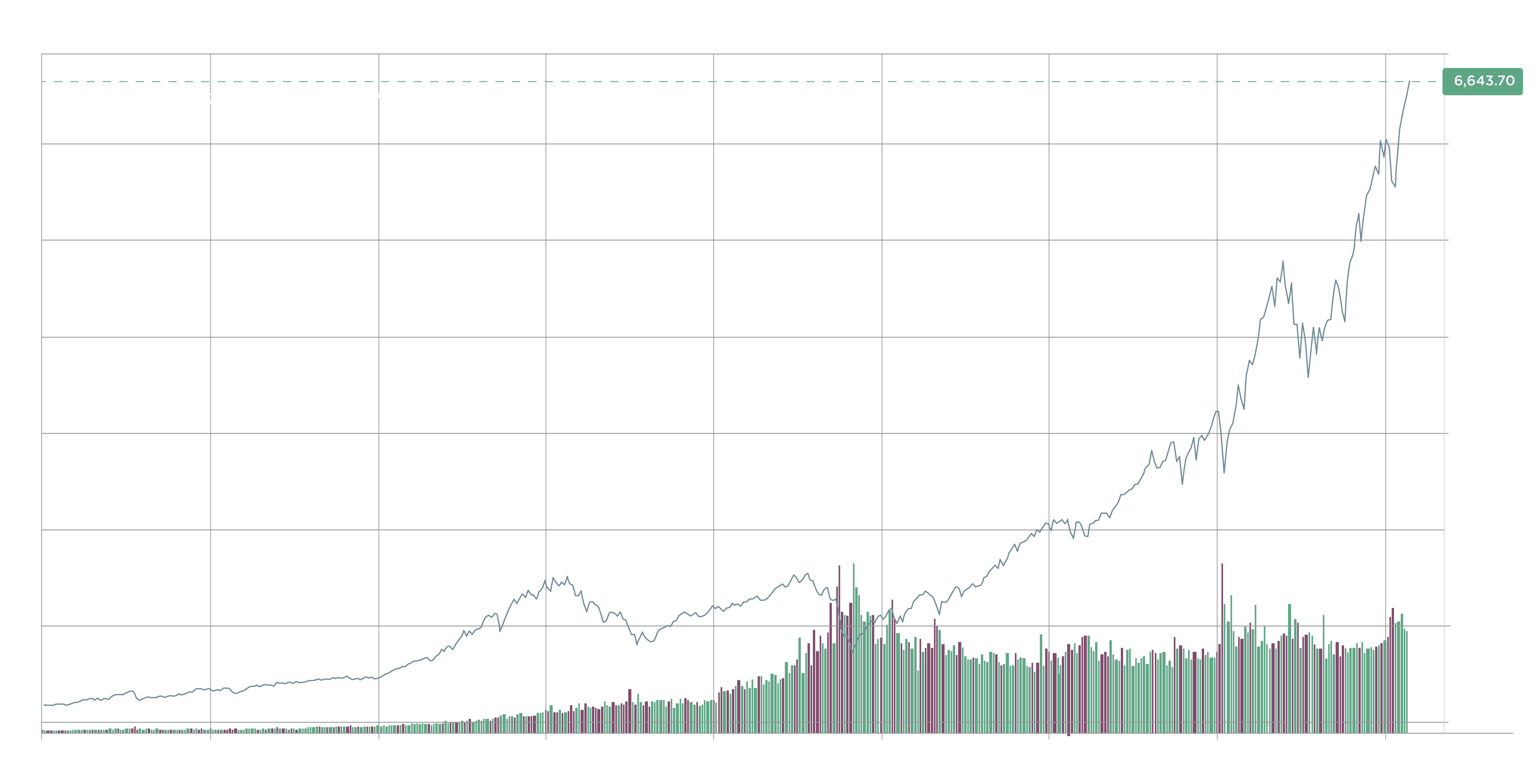

The stock market itself is in robust health. The question is not whether it has grown, but if that growth is sustainable. Take a look at this graph of the S&P 500 going back 40 years.

The reason for this is no secret. A combination of zero interest rates, quantitative easing, and outsize performance by a small group of tech stocks, the Mag 7 as they are now called, have driven this dizzyingly high performance of the US public markets since Chuck Prince uttered his fateful words.

The investor Nassim Taleb once observed that a car driving at 200 mph in downtown Manhattan would have an “effective speed” of 0 mph. His point: relying solely on a single gauge (the speedometer) is useless if you ignore the surrounding territory (gridlocked intersections, double-parked trucks, and swarms of pedestrians).

Now that rates have risen and quantitative tightening is underway, all the burden of the continued growth rests on the shoulders of tech giants. While it is theoretically possible, and as techno-optimists would argue, highly probable, that this growth will continue, history suggests that we should be cautious.

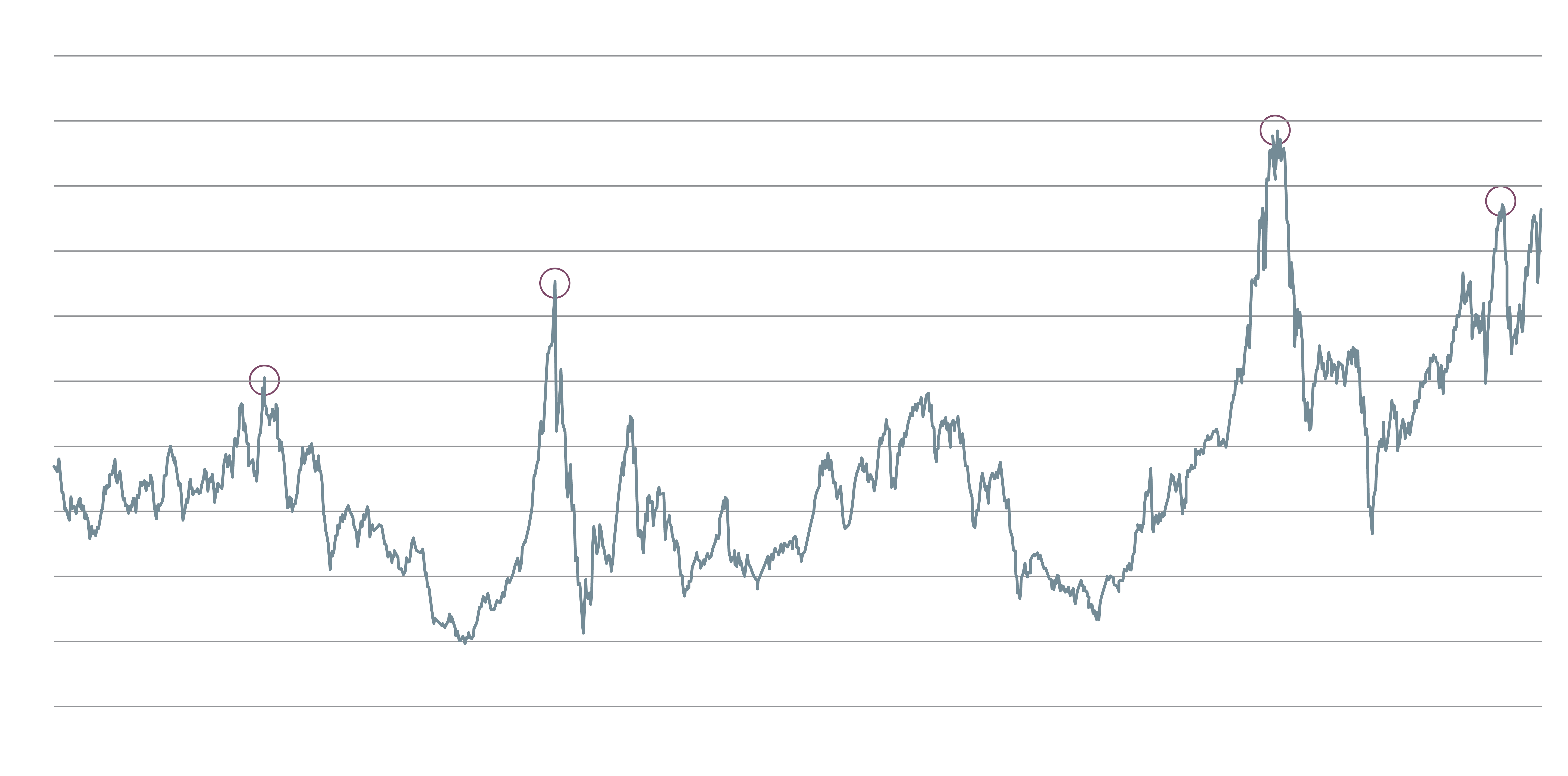

The Shiller CAPE Ratio is a trusted indicator of irrational exuberance. This graph tracks its movement over the last century.

The peaks highlighted in the graph preceded the historic market crashes of 1901 and 1929, the Dot Com crisis of 2000, and the post-COVID pullback of 2021/2022. The metric is not an infallible predictor of stock market doom - it did not ‘predict’ the Great Financial Crisis - but it is enough to give pause to the more bullish of market participants.

What Can Be Done?

The more bullish of market participants can tender numerous arguments as to why this time it really is different. And to be clear, it would not be wise to sell all stocks and pile up cash under the mattress.

But it would be wise to limit one’s exposure to a potential crash or correction. This is why investors are increasingly turning to private markets.

Private investments, as we have covered extensively in previous articles, are a way to restore diversification in an age when a simple 60:40 portfolio of stocks and bonds is losing its effectiveness.

As the value of private investments is not subject to minute-by-minute revaluation driven by sudden bouts of panic or euphoria, investors are more psychologically buffered as a result.

Perhaps most importantly of all, private investments allow for a genuinely long-term approach, in which the investment managers can affect strategic and operational changes to mitigate the macro-environment, even when a full-scale crash or economic meltdown is underway.

This is increasingly evident in the behavior of forward-thinking investors. For example, Preqin reported that the number of family offices with private markets exposure has increased by 524% since 2016.[5]

Conclusion

Rather than dancing to the tune of the markets, we recommend our investors take control of their future. It may be the case that the current bull market continues to run for another decade, as technological advances defy the normal laws of investing gravity.

But it is also true that wisely managed private investments are equally capable of delivering market-beating returns. Hence, keeping a foot in both camps is the most prudent course of action to take.