The past six months have done little to disconfirm this. Tariff negotiations, nuclear tensions, concerns over sovereign debt, and the beginning of European re-armament, all combine to form a picture of a world further degenerating from orderly globalisation to chaotic multi-polarity.

We’ve gathered mid-year insights from 10 global financial institutions, including banks such as JP Morgan and Barclays, as well as specialised asset managers such as KKR and Carlyle, and synthesized their findings in this article.

Our aim is not a comprehensive rehearsal of their various, sometimes conflicting theses, but to extract the common strands and weave them into a workable narrative, which investors can use to reflect and regroup as the second half of the year comes rushing towards us.

Bidding Farewell to the “Ancien Régime”

As already noted, the pre-pandemic world is no more. As many, if not most, financial professionals have this former world and its assumptions as their baseline (and some may be vainly hoping for its return), it is worth beginning by defining this ‘ancien régime’ we have lost.

Blackrock uses the term ‘macro anchors’ to describe the foundations of the old regime: stable inflation, predictable growth, fiscal discipline, and confidence in US assets.[1] What we have instead, according to HSBC, is heightened policy uncertainty, elevated inflation, and the geopolitical realignment of trade, capital, and growth.[2]

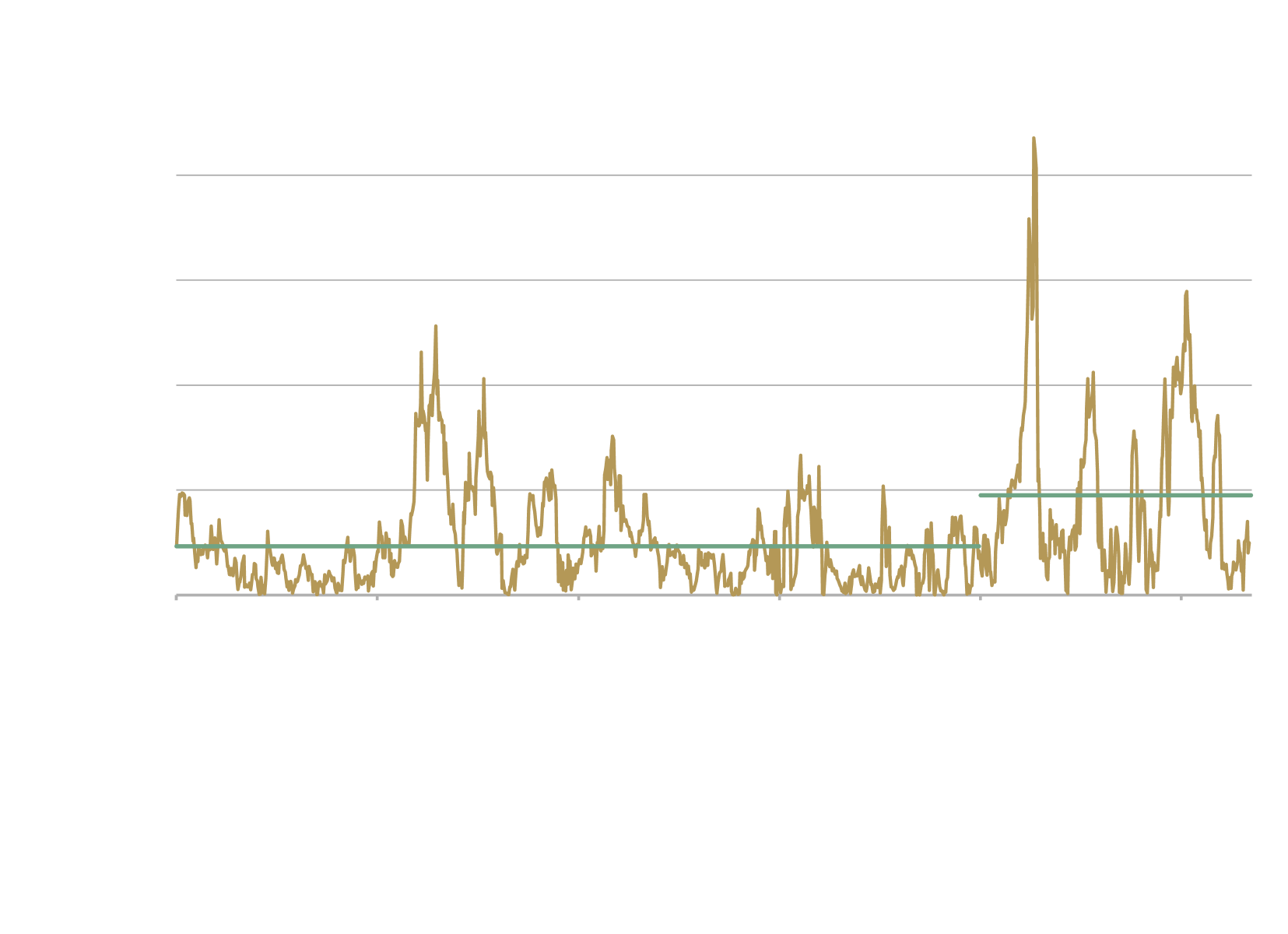

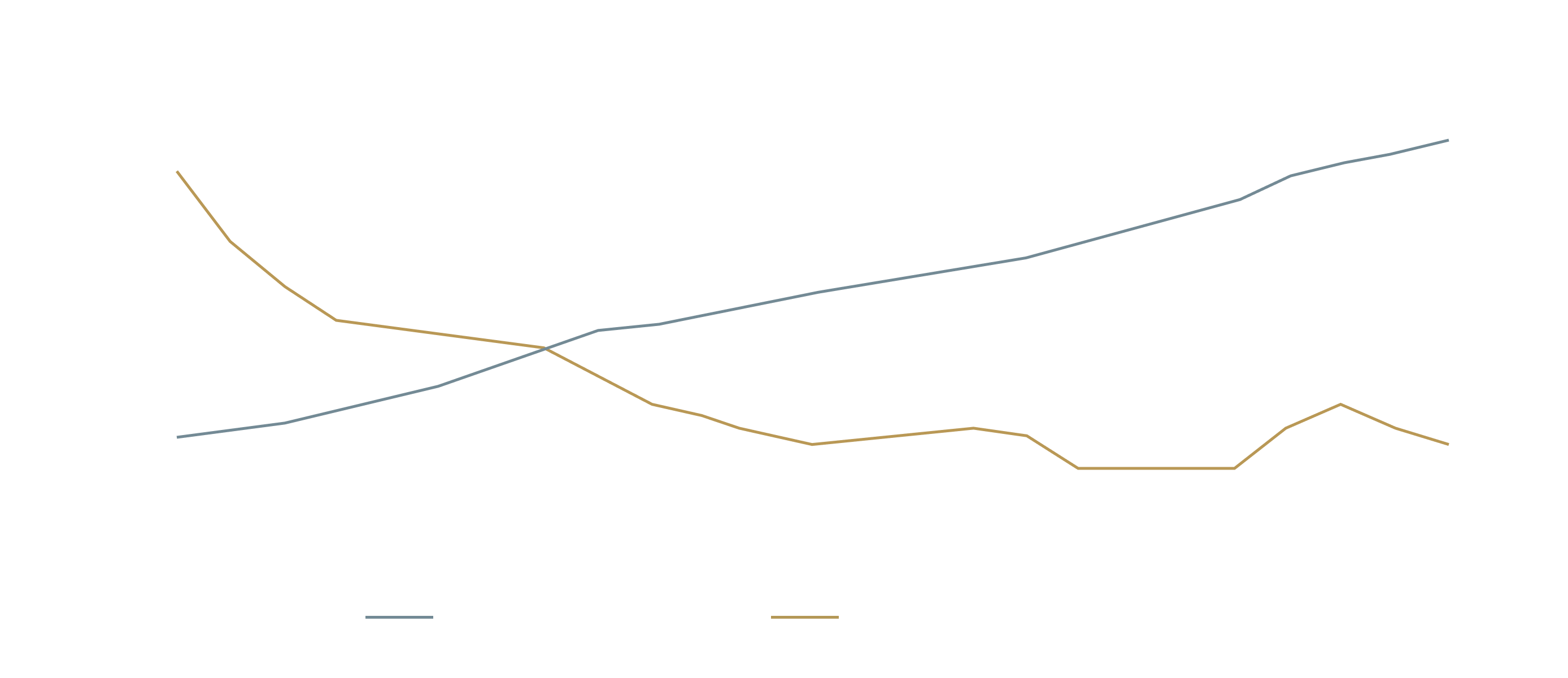

The chart below shows the fundamental problem for the stock market. Equities are more sensitive to the macro environment than they were before, blurring the lines between investing and geopolitics.

Now that heightened volatility is structural rather than exceptional, we need to reassess the playbook that has served investors so well during the prior two decades following the Global Financial Crisis.

We can no longer expect asset class returns to remain faithful to long-term averages. Nor can we rely on the calm economic backdrop, that made it possible to generate attractive returns passively through index-based investing in public stocks and bonds.

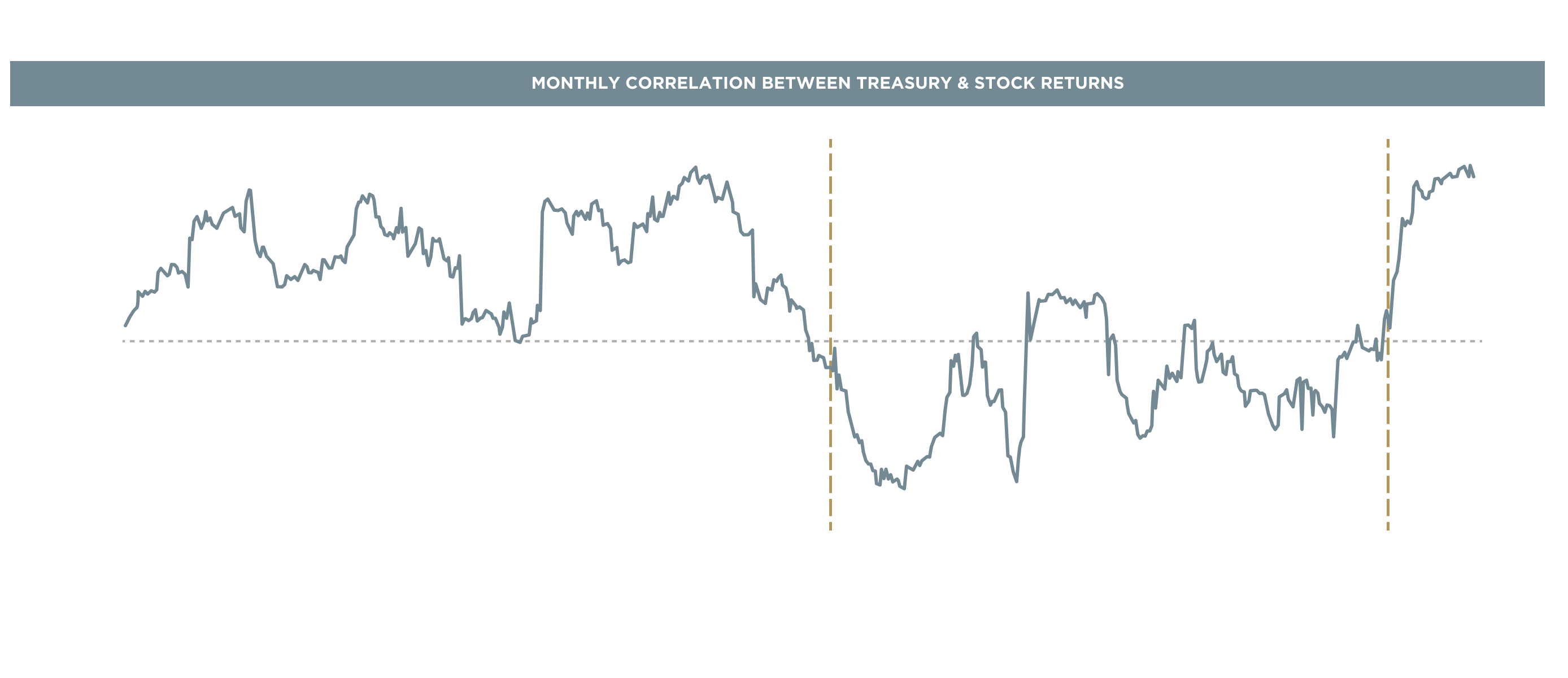

The longer-term effect of tariffs (and indeed the near-term effects) are unknown, but the initial market reaction to the Liberation Day announcements in April 2025 showed that the stock-bond correlation, which has turned positive since the pandemic (see chart below), can no longer be relied upon as a straightforward route to diversification in a crisis (more on this further below).

Global Markets in Flux

The US remains dominant in global finance, as the country with the largest and deepest financial markets, the number one reserve currency, and the main transaction currency.

Source: JP Morgan

Source: JP Morgan

As a result, the majority of commentary and market scrutiny is focused on its continued economic health.

Much of the “hard” US economic data (such as GDP growth, inflation, and corporate profitability) remains benign.[3] Furthermore, after a difficult first four months of the year, markets more broadly have recovered since April, with particularly impressive growth in Europe, China, and Japan.[4]

While the rise of gold and the accompanying pressure on the dollar could be seen as a warning sign for US dominance, it is also plausible that these are merely indicators of tariff-driven anxiety and, therefore, likely to be temporary.

The New Playbook

While there may be differences in opinion as to the future of the globe’s economic equilibrium and its new center of gravity, no one claims to know for sure. History does not always follow a rational path, and the future is unlikely to do so either.

That said, the one thing we can be certain about is heightened uncertainty. And in this light, there are various things investors can do to update their approach.

HSBC summed up the new approach as ‘granular, global and adaptive’.[5] Let’s go through each one in turn:

Granular means looking closely at sectors and companies themselves to select for quality and insulation from headwinds. For example, prioritizing companies with strong balance sheets ahead of a stagflationary environment, or focusing on industries least exposed to tariff fallout (cable/telecom, healthcare, utilities/power[6]).

More positively, it could mean getting ahead of the market in areas that have been overlooked in the furore of the trade wars, such as AI[7] or the energy infrastructure needed to undergird its expansion. KKR points out that a frothier environment naturally leads markets to misprice complexity, leaving open goals for methodical investors.[8]

Global means reducing exposure to concentration in any particular market, such as US stocks, which currently account for 70 cents in every dollar that flows into public equities worldwide.[9] Within the S&P 500 itself, the so-called Mag7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla) account for nearly one third of market capitalization.[10]

Some commentators pointed to heightened defense spending in Europe, where the EU nations have recently committed to 5% of GDP, the return of inflation in Japan (where investors are rotating out of cash into stocks), and fiscal stimulus in China as definitive areas of potential ex-US outperformance.[11]

Adaptive is a more nuanced word, but perhaps the most important of the three. At a basic level, it means adopting not merely an active approach, but a proactive one - expecting the ground to move and being willing to change strategy.

A more aggressive interpretation of the word ‘adaptive’ could be what KKR refers to as ‘making your own luck’, or in other words, finding assets where one can influence the outcome, rather than simply being exposed to it. This dovetails with another important theme emphasized by several of the reports, which is the need for diversification through private markets.

The New Portfolio

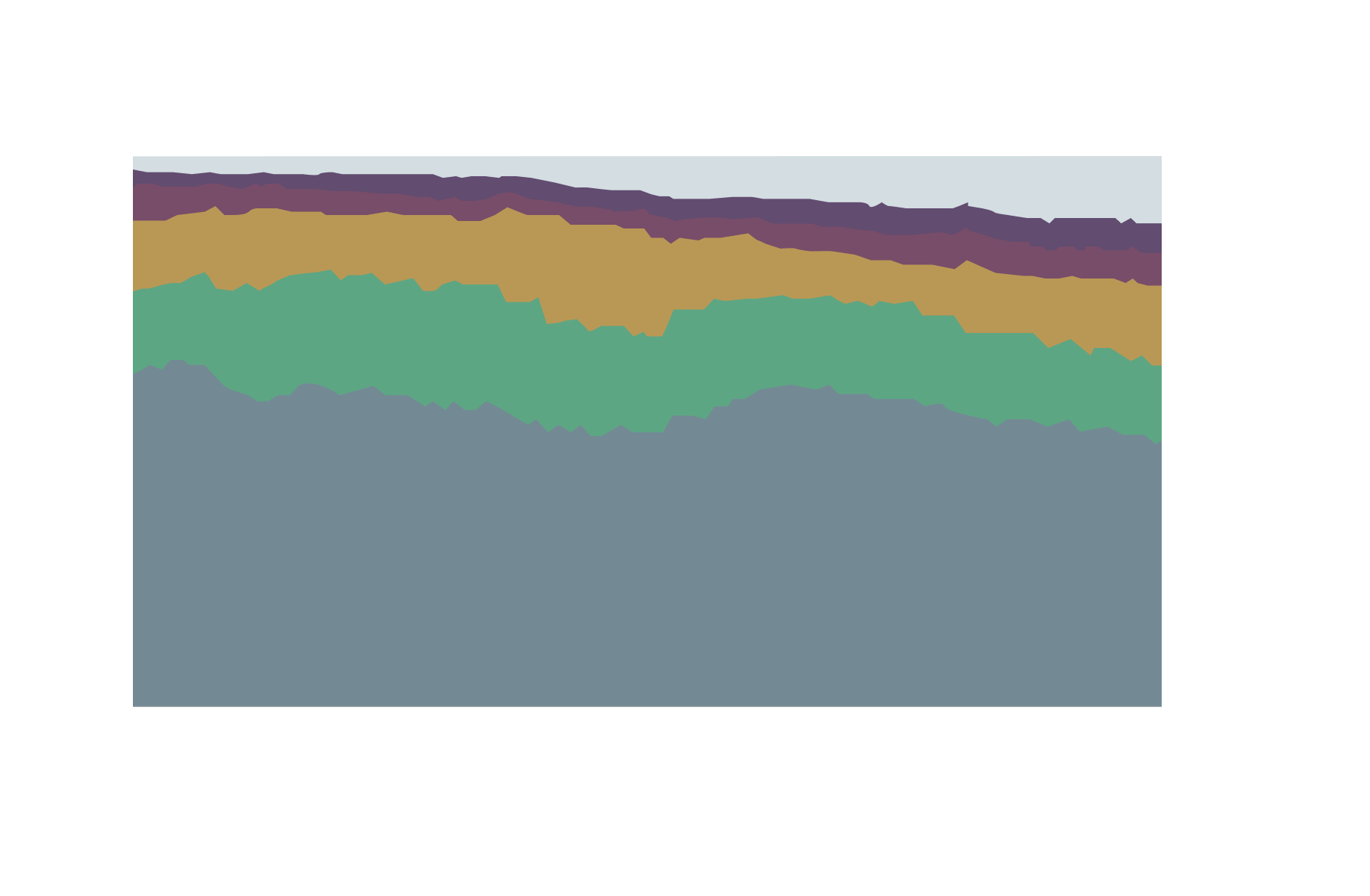

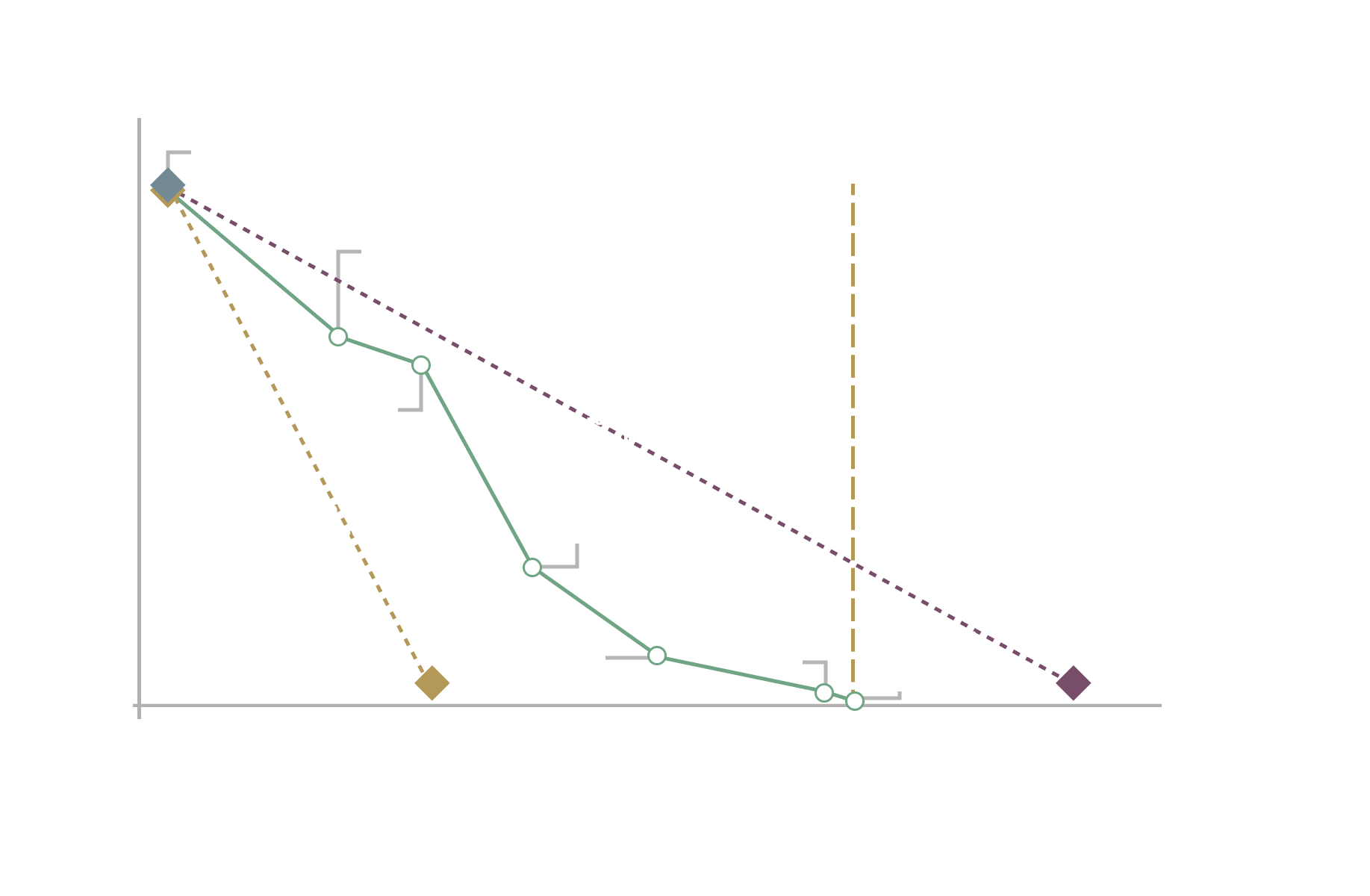

Private markets, which include private equity, private debt, real estate, and infrastructure, are a growing force in global finance, and for good reason.

Companies are staying private for longer, thanks to the increased confidentiality and freedom this allows them.[12] Meanwhile, governments are seeking private capital to fund much-needed infrastructure projects that cannot be funded within already over-levered budgets.[13]

For investors, investing in private enterprises has many advantages as well. In the first place, it widens the investing landscape. The number of US companies backed by private capital is more than double that in the public markets.[14] This level of choice makes it possible to be more targeted and strategic in selecting one’s exposure to volatility-proof trends.

Amongst its many benefits, private markets investing also offers the increasingly rare and vital commodity: diversification. Nearly three-quarters of public market returns are directly attributable to swings in the broader market[15], which dulls the effect of prudent selection. Private markets are naturally more insulated from market gyrations.

The additional level of control afforded by private markets is increasingly believed to be the source of their superior returns.

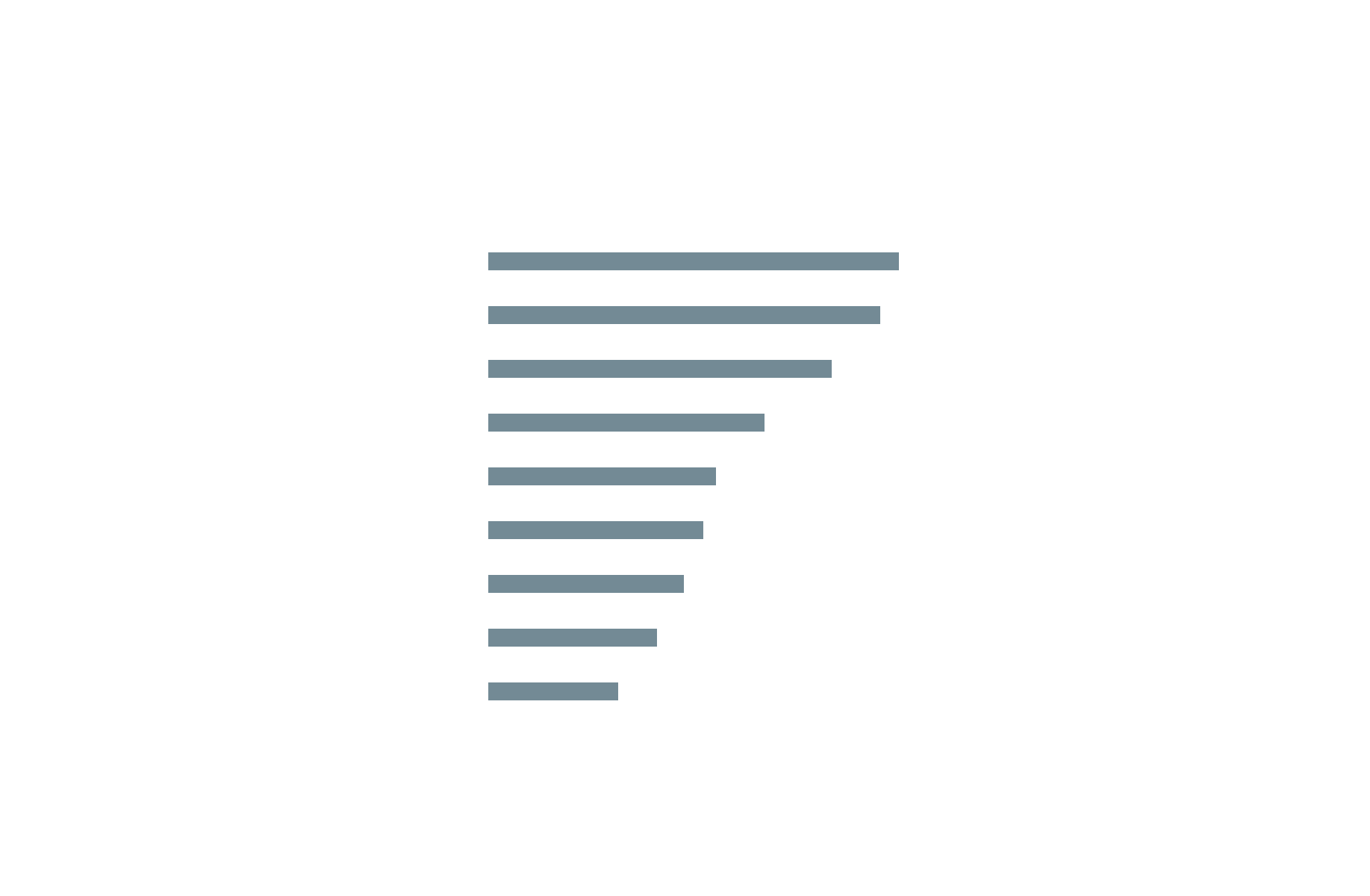

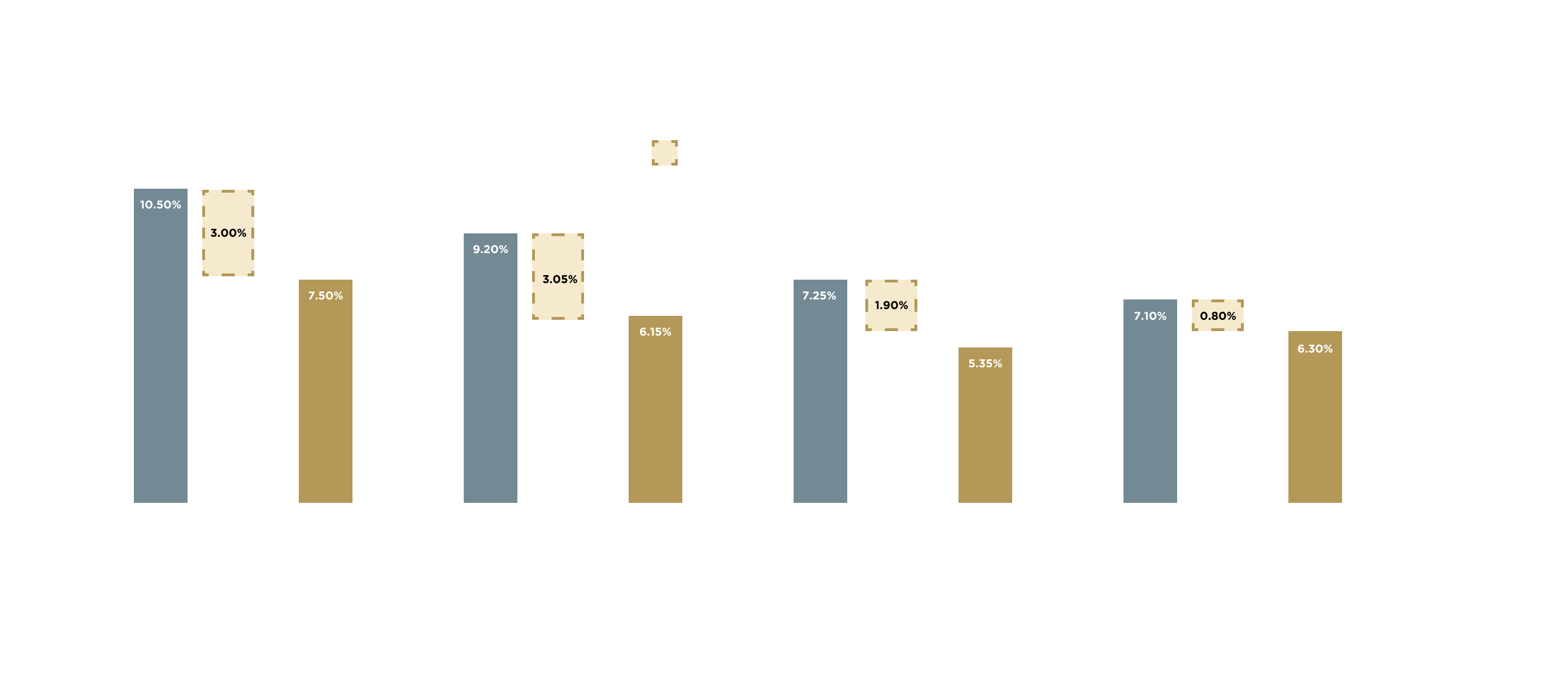

The private market premium is estimated to range from 50 basis points to 500 basis points, depending on the asset itself (the chart above represents a selection). Various studies have shown that adding a 10%-20% allocation to a standard retirement portfolio can materially improve returns without increasing risk.[16][17]

In an age of heightened uncertainty, this, - one could say, is worth more than gold.

Conclusion

Much of the financial commentary one reads is, naturally, concerned with the task of predicting the future. While understandable, it is also impossible, and not where the focus of a prudent investor should lie.

There is, however, a positive lesson we can draw from amid the ever-changing speculation, and that is that a more volatile, uncertain environment is only a danger to a passive investor. Volatility creates dislocations between price and value. To an active, informed investor, this is actually better than a period of predictable calm, in which the rising tide lifts all boats together.

In the Barclays report, we find another level-headed observation that provides reason for optimism: market performance is ultimately driven by long-term economic growth, which is in turn driven by technological advances and ingenuity.

As the blistering pace of progress in AI, particularly Large Language Models (LLM), shows, neither of these is likely to disappear, even if the economy is troubled in the near term.

Successful investing is a question of character as much as, or maybe more than, intellect. And definitely not clairvoyance.

Successful investing is a question of character as much as, or maybe more than, intellect. And definitely not clairvoyance.