The Illusion of the Long-Term Leader

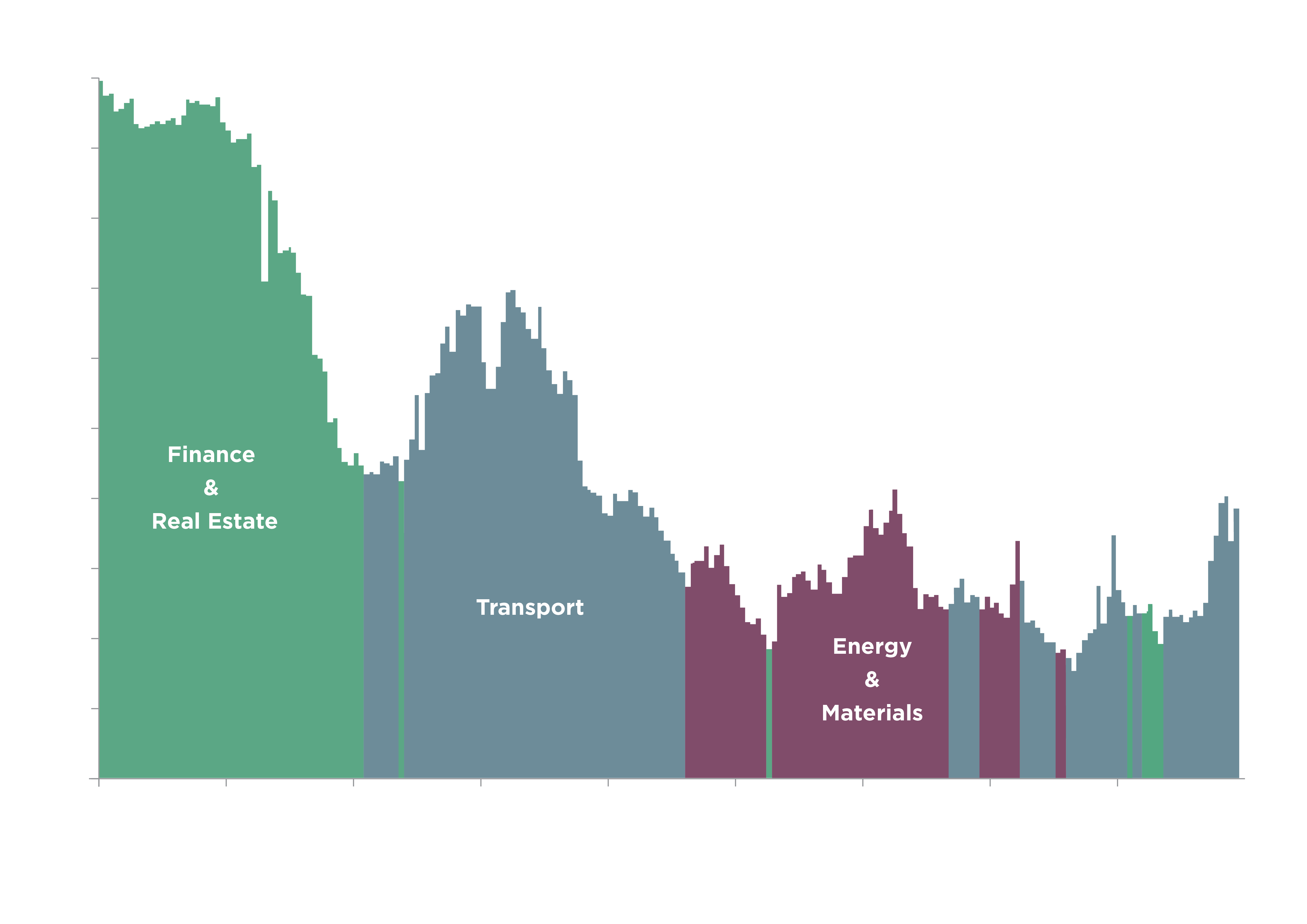

Sectors that dominate headlines don’t always deliver lasting results. Over time, leadership in the market has shifted again and again. Research from Goldman Sachs shows how this has played out: in the 1800s, financials and real estate led the way; in the early 1900s, transportation took over; mid-century, it was energy and materials; and today, technology and communications are at the top.[1]

But popular sectors don’t always live up to the hype. From the Canal Mania of the 1700s to the dot-com bubble, some of the most celebrated industries have ended in disappointment.

Focusing too heavily on one sector brings risk. Even strong industries can stumble or fail to bounce back, leaving investors exposed to lasting losses.

Sector Leadership Is Unpredictable

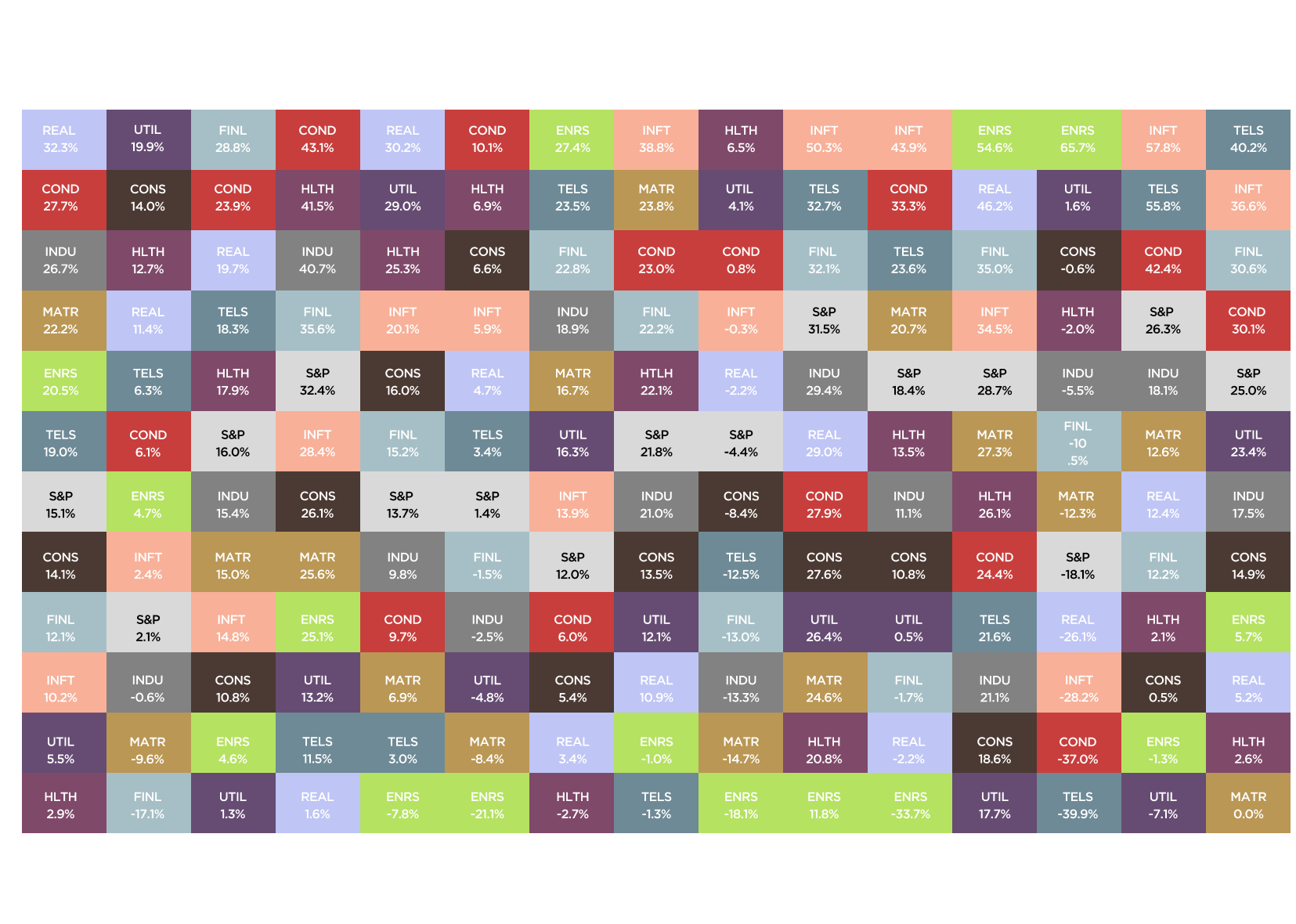

Many investors assume that top-performing sectors will keep leading, but that’s rarely the case. Sector performance changes often and without clear patterns. One year, technology may lead the market; the next, it might lag behind. Meanwhile, steady sectors like utilities or consumer staples can outperform during more volatile times.

Because sector leadership shifts so unpredictably, even experienced investors struggle to time it right. A more effective strategy is to stay broadly invested across sectors, so you’re well-positioned to benefit wherever growth occurs.

In addition, overall market returns are often driven by a few standout companies. Missing out on these can significantly hurt performance. Diversifying consistently is the most reliable way to make sure you don’t miss those key opportunities.

Why Diversification Works

Diversification isn’t just about limiting losses; it’s also about increasing the chances of long-term success. By spreading investments across different sectors, investors reduce the risk that one setback will affect the entire portfolio. When one sector struggles, others may help balance the impact or even drive growth.

It’s also important to avoid herd mentality and steer clear of overcrowded trades, especially when valuations become stretched. Putting too much into one area can lead to sharp ups and downs, which often triggers emotional decisions like selling in a downturn or chasing short-term gains. A more balanced portfolio helps smooth out those swings, making it easier to stay on track with long-term goals. In the end, staying invested with discipline can be just as important as choosing the right investments.

How The Family Office Implements Sector Diversification

At The Family Office, sector diversification is a core principle of our investment approach. We avoid speculative trends and refrain from concentrating exposure in any single sector or theme. Our strategies are purposefully diversified across industries to strengthen portfolio resilience and seize opportunities as they arise throughout different market cycles.

This disciplined approach helps reduce vulnerability to sector-specific downturns and minimizes the risk of being overly reliant on industries that may face long-term decline. By maintaining thoughtful and consistent diversification, we increase the likelihood of capturing long-term outperformers, resulting in more stable and predictable investment outcomes.

Final Thoughts

The real question isn’t which sector will outperform next, but whether your portfolio is prepared to benefit no matter which one does.

At The Family Office, we design portfolios built not on speculation, but on strategic diversification. Our focus is on preserving capital, capturing consistent growth, and guiding our clients with clarity through all market conditions. With two decades of experience navigating economic cycles, we offer our clients the insights and stability they need to pursue their goals with confidence.